Our Story

Our Credit Union was created in 1935 to serve Long Beach school employees. Long Beach School District Employees Federal Credit Union, as LBS Financial was originally called, was operated out of homes and a classroom at Wilson High School. The staff were mostly volunteers who wanted to help the members of their community have affordable, trusted financial options.

In 1939, the first Credit Union office opened on 10th and Ximeno in Long Beach. About a decade later, LBS Financial purchased the office and land that its first building sat on, making it the first credit union west of the Mississippi to own its own building. We still own and operate this branch today.

Over the last 88 years, we’ve experienced tremendous growth and expansion, but have remained true to that original commitment to serve. We are now able to serve anyone who lives or works in the local area in addition to our school and college employees. The stability of our Credit Union starts with our CEOs who have faithfully served for extended tenures. We’ve had only four CEOs over our lifetime, with the majority having served the Credit Union for decades.

What We Continue to Do

We continue to serve school and college employees, but we also have a state charter and now serve anyone who lives or works in our local community. Our products, services, and rates have adapted to serve our Members but our underlying commitment has not changed. We’re owned by our Members and committed to delivering them great financial products and trusted, friendly service.

LBS Financial Credit Union operates day in and day out with these values top of mind:

Member Focus

Relationships

Transparency

Education

Our roots are in education, and education creates financial freedom. LBS Financial champions financial well‐being for our Members and supports education in the communities we serve. Building knowledge and providing ongoing training to our Employees is critical to serving our Members well.

Mission Statement:

To provide Member‐owners with Extraordinary Service Experiences and desirably convenient products and services that enhance their financial well‐being.

Vision Statement:

To be the most highly desired and Member-valued financial institution in Long Beach and surrounding communities.

Why Choose a Credit Union?

Credit unions offer similar products and services to banks, but have differences in ownership and company goals. Credit unions are owned by their members and are not-for-profit organizations that aim to improve members’ lives by offering great rates and affordable loan terms. Banks price products to make a profit, credit unions price products to serve.

- Credit card rates are generally about 4% better

- Dividend rates on savings can be 1% better in some cases

- Auto loans are generally 1.5% better

How We Responsibly Protect Your Money

Credit unions are closely monitored and regulated to ensure that we use best practices to protect you and your money. Credit union members have never lost a penny of insured savings at a federally insured credit union, and our deposit insurance fund has the full faith and credit backing of the U.S. government.

LBS Financial is considered “well-capitalized” by our State and Federal regulators and is one of the most financially sound credit unions in the State of California. To be considered “well-capitalized” a credit union is required to have a minimum of 7% in net capital. LBS Financial has nearly double this requirement with 12.42% in net capital as of December 31, 2022. Review our 2023 Annual Report for more information on our financials.

All your deposits are federally insured to at least $250,000 per depositor (and separately per IRA) by the National Credit Union Administration (NCUA), a government agency. In some cases where those benefits stack, you may have funds insured up to and beyond $1 million.

Visit the NCUA website to download a pamphlet with more information on NCUSIF insurance. Use the NCUA Share Insurance Estimator to better understand your share insurance protection.

Board of Directors

Our Board of Directors are made up of Member-volunteers that are committed to the long-term success of LBS Financial Credit Union and its Members.

.

Chair

Dr. Jay Camerino

Vice Chair

Dr. Larry Natividad

.

.

Secretary/Treasurer

Dr. John Fylpaa

Board of Director

Dr. Satinder Brar Hawkins

.

.

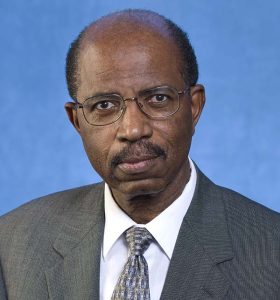

Board of Director

Pamela Seki

Board of Director

Luther Williams

.

Supervisory Committee

Chair

Dave Conrad

Committee Member

Alan Ray

.

Committee Member

Mark Aldrich

Executive Management

.

President & CEO

Sean Hardeman

.

Annual Report

LBS Financial Credit Union had a solid financial performance in 2022 and continues to be one of the strongest, well-capitalized credit unions in the State of California.