Accounts

If you would like to close your Membership account(s) at LBS Financial, you may visit any branch location, call us at 800.527.3328, send us a secure message through Online or Mobile Banking, or mail us a signed letter that includes your account number you wish to close at:

LBS Financial Credit Union

P.O. Box 4860

Long Beach, CA 90804

Please keep in mind that LBS Financial retains Member information beyond your account closure for legal purposes, for a period of time. If you wish to keep your Membership account but close additional checking or savings accounts, this can be also done using any of the methods above. There may be a delay in account closures if there are pending transactions or a loan payoff required.

Copies of your checks may be viewed within Online or Mobile Banking. Log in to Online Banking to view a copy of your paid check. Within Online Banking, click on your Checking account from the History page and click on the check icon next to a transaction. If you have signed up for eStatements you can also click on a check within the statement to view. If you need check copies and prefer not to use our Online or Mobile Banking, you may visit one of our branches or call us. You may obtain free photocopies of two checks per statement. If you need more than two checks per statement, there is a small fee. View the most recent Fee Schedule.

View our current Fee Schedule to see all the fees associated with having an account.

Before visiting one of our branches for a Notary, please call the Credit Union to check on availability for that day.

Please contact us right away at 800.527.3328 to let us know of any fraud on your account. You may be required to visit one of our branches to fill out an Affidavit of Fraudulent Use of a Credit or Debit Card.

You may write us a letter stating the reason for your dispute, details of what transpired between you and the merchant, date(s) and signed by the account holder. You may also visit one of our branches to complete a Dispute Certification.

Provide your LBS Financial’s routing and transit number (322276855) and your account number. Specify if you want the funds credited to your Share Draft/Checking or Share Savings account.

Provide your LBS Financial’s routing and transit number (322276855) and your account number. Specify if you want your funds debited from your Share Draft/Checking or Share Savings account.

To place a stop payment, visit one of our branches, use Online Banking and click on Accounts, expand the view to see more detail, then click on Stop Check, or access your account through HomeTeller to place the stop. View our Fee Schedule to see the current Stop Payment fee.

Checks can be ordered within Online and Mobile Banking, through Harland Clarke or by contacting us.

Please follow these instructions for all incoming wires in US dollars:*

Send Funds To:

FIRST CREDIT:

Farmers and Merchants Bank

Routing/ABA number 122201198

3140 East Anaheim Street

Long Beach, CA 90804

SECOND CREDIT:

L.B.S.F.C.U.

Account number #02000040

FINAL CREDIT:

Your name

Your LBS Financial Credit Union account number and suffix

*Please contact the Credit Union if the incoming wired funds is in foreign currency other than US Dollars.

You may call or visit a branch to inform us. The primary Member will need to sign a new Membership Application and the joint owner needs to fill out a Voluntary Surrender of Account Ownership form. The Primary and Joint Owner both need to sign this form.

If eligibility requirements are met; you may click here to print and mail an application, visit a branch to fill out a new Membership Application or call one of our representatives to request one by mail. You and the new Member must both sign the Membership Application.

Just provide your employer with the LBS Financial’s routing and transit number (322276855) and your account number. Specify if you want your money to be deposited to your Share Draft/Checking or Share Savings account. Use the account numbers on the bottom of your LBS Financial check(s). Please make sure to ask your employer or issuer of the check for their specific procedures to sign up for direct deposit.

322276855

You may make a transfer by calling one of our phone representatives, visiting a branch, accessing your account by phone through HomeTeller, through Mobile Banking or through Online Banking.

Overdraft Protection is a service that allows a checking or money market savings account to be linked to another account that provides protection against returned items or overdraft. When you open an Interest Checking or Free Checking with eStatement account, you have the option of signing up for Overdraft Protection using an LBS Financial Share Savings account, Special Savings, or Money Market account.

Access your account 24/7, 7 days a week by logging on to Online Banking, through Mobile Banking or through our automated phone system, HomeTeller. You may also contact one of our representatives during business hours or visit one of our branches. Our Bixby (walk-up only), Cerritos, East Long Beach, Lakewood and Los Altos branch are open on Saturdays from 9:00 a.m. to 2:00 p.m.

Click here to request removal of the Dormant Status on your account.

Once deposited or cashed, the time it takes a check to clear will depend on several factors. If the financial institution of first deposit or the paying financial institution processes checks through a clearing bank, it may add an extra day to the time it takes for the check to be entered into the Federal Reserve Bank. If the payee’s financial institution is not local, it may add extra days to the time it takes the check to reach the paying bank. If the check is damaged so the MICR line is illegible, it may add days or weeks to the time it takes the check to reach the paying financial institution.

Many financial institutions are now converting checks into optical images that are cleared electronically. The Check 21 items can clear on the same date they are received by the payee’s financial institution. Other checks may be converted into ACH electronic items which will speed up the time it takes to clear.

Although a check is considered “Stale Dated” if it was written more than 180 days prior to presentment for deposit or payment, the paying financial institution may pay the check. A check represents a contract between the issuer of the check and the payee and there is really no time limit on when that contract expires. The payee could pursue payment of a check well beyond 180 days and even for years after the check was written.

In order to determine whether an item will be placed on hold, it is necessary for one of our member service representatives to see the actual check item. You will be notified of any applicable holds.

There are a variety of reasons that a hold may be placed on your funds. Holds are placed on deposits involving checks to ensure that the deposited checks pay before funds are released. If a check is dishonored by the paying bank, the hold ensures that the funds are still in your account when the deposit is deducted. When you accept a check from anyone, it is subject to final payment and your responsibility, not the Credit Union’s, to collect from the person who wrote the check should it come back unpaid. Holds can be placed on unverified ATM deposits and Shared Branch deposits. If we are alerted that a check is coming back unpaid, a hold will be placed on your account for the amount of the check. If we suspect fraudulent activity is occurring, holds may be placed to safeguard your funds. Holds are also placed on funds when we are served with a levy or other legal notification

There is no fee for our Free Checking with eStatements account. Our Interest Checking account has a $3.00 monthly fee which is waived if you maintain an average daily balance of $500 in Interest Checking or an average daily balance of $2,000 in combined accounts under the same account number.

LBS Financial assesses a $3.00 monthly fee for the Interest Checking account to cover the costs associated with managing your account. The fee is waived if you maintain an average daily balance of $500 in Interest Checking or an average daily balance of $2,000 in combined accounts under the same account number. You may also sign up for our Free Checking with eStatements account. This totally free account has no minimum balance or other requirements with the exception of receiving eStatements (in lieu of paper statements).

You may click here to open an account online or visit one of our branches with a copy of your Driver’s License and a $5 Share Savings Account deposit and $1 membership fee.

Click here to visit our membership eligibility page

Yes. Please mail your deposit or loan payments to:

LBS Financial Credit Union

Attention: Central Mail Processing

P.O. Box 4860

Long Beach CA 90804

You may perform transactions 24 hours a day, 7 days week by using our automated phone banking, HomeTeller or you may speak to one of our representatives during normal business hours.

You may visit our Bixby Knolls, East Long Beach or Newport Mesa branch to conduct routine transactions through the CO-OP Shared Branch network.

Credit unions are so unique that they work together to provide access to nearly 30,000 no surcharge CO-OP ATMs, including Costco throughout the U.S. and Canada. A CO-OP ATM is like an extension of LBS Financial Credit Union, providing you with easy access to your account without surcharges or fees.

Click here for our branch hours and locations.

Auto Loans

We offer several options for paying off your LBS Financial auto loan. Please call us to get your pay off amount as the amount changes daily due to interest.

Options for paying off a vehicle loan:

1. Transfer options

- Transfer funds from an LBS Share Savings or Checking to your loan with Online or Mobile Banking

- Transfer funds from an account outside the Credit Union to your LBS Financial Savings or Checking account using the Online and Mobile Banking external transfer feature, then transfer money to pay your loan from your LBS Financial account. External transfer limits apply and transfers can take 3 business days to process. Click here for more information about external transfers.

2. Pay on our website using LBS Easypay

- Routing and checking account information is required

- $5,000 limit applies per business day

3. After contacting us to get your payoff amount for a future date, set up a payment through your financial institution's bill payer.

- You may need to provide them with the following information:

- Payee name: LBS Financial CU

- Routing number: 322276855

- Your LBS Financial CU Member account number: XXXXXX (To ensure the payment is routed to your loan, add your loan suffix number to the end of your Member number, such as 01 or 02)

- There may be a limit on the amount you can send, please contact your financial institution’s bill payer for their limits.

4. Use our payment by phone option with your routing and checking account information

- Call 866.923.6404 to pay through the automated phone system or call us to pay with a representative

- $10,000 limit per business day

5. Visit one of our eight branches or any CO-OP Shared Branch in the United States to deposit your payment to your Share Savings account to be transferred to your loan.

6. After contacting us to get your payoff amount for a future date, you can pay by mail by sending your check to:

LBS Financial Credit Union

P.O. Box 4860

Long Beach, CA 90804-0860

Fill out an online application, or come see us at any branch.

For a loan pre-approval good for up to 60 days, apply online, visit any branch, or give us a call.

When LBS Financial obtains your credit score during the pre-approval process, the Credit Union will determine your loan rate based on your past financial history and credit. Take note that the Credit Union must obtain your credit report personally; they will not accept copies of credit reports from third parties.

We process most applications within one business day. Applications received over the weekend or holidays are processed the next business day. You may check your status by calling us.

There are a variety of ways to make a payment towards your LBS Financial loan.

LBS EasyPay

Use our LBS EasyPay service to make one-time or recurring payments to your LBS Financial Consumer Loan from an account at another financial institution. There is no fee for this self-service payment channel and it can be accessed from any browser on a computer or mobile device. Access LBS EasyPay.

There’s no charge for this service.

Schedule Recurring Payments through Online Banking:

You may establish a recurring transfer from your LBS Financial account to your LBS Financial loan. Log in to Online Banking to set up your automatic transfer.

There’s no charge for this service.

External Transfers

Transfer money from an account outside the Credit Union to your LBS Financial Savings or Checking account using Online and Mobile Banking, then transfer money to pay your loan from your LBS Financial account.

There’s no charge for this service.

Make a Payment by Phone

You may make a payment from another financial institution to your LBS Financial Credit Union loan by calling 866.923.6404. View our Fee Schedule. You may also call 800.527.3328 to make a payment from your LBS Financial account to your LBS Financial loan at no cost to you.

In Person:

Visit one of our eight branches or any CO-OP Shared Branch in the United States to drop off your payment. Find a branch or ATM.

Mail:

You may pay by mail by sending your check, along with a loan payment coupon or the remittance portion of your monthly billing statement (depending on the type of loan you have) to:

LBS Financial Credit Union

P.O. Box 4860

Long Beach, CA 90804-0860

LBS Financial will release the lien and the DMV will print and mail the title to the last known address of the person with the loan.

Yes. On time payments mean a higher credit score. LBS Financial reports borrower, co-borrowers, guarantors, and co-signers payment habits to all three major credit bureaus: Experian, Equifax and TransUnion.

In your time of need, our claims process is quick and easy. If you elected payment protection on your loan, you can use this convenient claims process to quickly and easily file your claim.

To begin, please fill out a claim form. If you prefer, call 800. 621.6323 to begin the process and a CUNA Mutual Group Claims Specialist will guide you through the process.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Payment protection products include debt protection products available through the Credit Union.

Bill Payment

No, you can simply shred it. Our system provides all the necessary information to your biller. We encourage you to try our eBills, which are available through Bill Payment for eligible billers. You will see an "Activate eBill" or “Get eBills” option next to those billers. This will help you eliminate the paper bills coming to you in the mail.

eBills are regular statements delivered electronically by your eligible billers. You'll typically receive them each month at the same time you would receive a paper bill.* You can pay them automatically with Auto-Pay (under a certain dollar amount), or pay them manually within Online or Mobile Banking.

When you set up a biller in Bill Payment, you will have the option to set up eBills for eligible billers. To add eBills to an existing biller within Online Banking, select “Activate eBill” next to the biller on the Payment Center page. Within the Mobile Banking app, select “Activate eBill” on the billers tab.

*Please note that you'll no longer receive a paper bill if you opt into eBills. However, you can print or save your eBill statements for your records.

Zelle is a fast, safe and easy way to send and receive money with people you trust. We are not a Zelle partner institution, but our debit cards can work with Zelle when the other financial institution is a partner. Refer to our Zelle Guide on how to add your LBS Financial Debit Card on Zelle.

The CheckFree Bill Payment program is focused on making your payment on time, every time. CheckFree assumes the risk in paying your bill, whether or not the funds are available in your account.

- If your biller receives payments electronically, CheckFree will credit the biller on the due date you have indicated and then debit your account on the same day.

- If your biller receives payment by check, your account may be debited after the check is received and processed by your biller.

- If there are insufficient funds in your account, you will be responsible for an NSF fee. CheckFree will attempt to debit your account once more the following business day.

- If your payment returns, CheckFree will attempt to recover the funds from your biller.

- If CheckFree is unable to recover the payment, your Bill payment privileges may be frozen until Bill Payment recovers the funds owed to them.

Please review our Fee Schedule for current NSF and Uncollected Funds fees.

Yes! If you have not already, we recommend that you set up overdraft protection on your account. If you pay a bill and have non-sufficient funds to cover the bill, you are subject to the same NSF fee as if you wrote a check and didn't have the funds to cover it. With overdraft protection, you can protect your account from non-sufficient funds by using your Share Savings or Money Market to back up your Checking account. Contact the Credit Union to set up your overdraft protection.

Contact our Bill Payment provider, CheckFree, directly at 800.877.8021 between 4 am to 10 pm PT seven days per week. CheckFree guarantees payment of your bill by the payment date you indicate.

Recurring payments are automatic payments of the same amount. You do not have to re-enter a new payment each month. These payments can be scheduled for one of several frequencies:

- Weekly, every 2 weeks, monthly, every 2 months, every 3 months, every 6 months, annually

Yes, you can review, change, or cancel a payment at any time before it is processed. Payments may be processed up to 5 days in advance of the payment due date entered by the user.

This is our current payment schedule:

- Payments to electronic billers are delivered in 2 days

- Payments issued by check are delivered in 5 days

- When you schedule a payment, the payment calendar indicates the earliest available payment date

- Approximately 77% of payments to businesses receive payments electronically

That depends on whether the payee receives electronic payments or checks. Electronic payments post in 2 business days. Payees that receive payments by check will display as having a lead time of 5 days. Once the checks are mailed, we have no control over how long it takes your payee to debit your account. Paper checks may clear earlier than the pay date selected by the account holders(s) since they may be deposited by the payee upon receipt.

As long as you access the Bill Payer service at least once every 12 months, your billers and payment history will remain active and available.

Most payments to major billers and utility companies are sent electronically. These payments will typically be withdrawn from your account on the same date you select for the biller to receive your payment. Other payments are sent via a paper check drawn on your account. The checks will generally debit your account a couple of days following the date the check is deposited/cashed by your biller. These types of payments are typically for smaller merchants such as a gardener, pool cleaning service, medical bill, etc. Please note that paper checks may clear an account earlier than the account holder anticipated (including earlier than the pay date selected by the account holder), since they may be deposited by the payee upon receipt.

Most paper check payments are cleared through your account and you will be able to view these check images within Online Banking and print them. The easiest way to find copies of these checks is by finding the transaction by clicking on History, then finding the transaction and clicking on the check icon to view the check. You may also enter the check number to search for it in the box above your transaction history. If you cannot find a copy of your check, the Credit Union still may be able to provide it. Just call the Credit Union (800.527.3328) and ask for copies of the check. Please refer to our Fee Schedule for our check copy fees

If your payment has not yet been sent by CheckFree to your biller you may cancel the payment. Within the Mobile Banking app, select the scheduled payment on the Activity tab and select “Cancel.” Within Online Banking, select the pending payment on the Payment Center screen, and select “Cancel.” There’s no fee to stop the payment by clicking the cancel button. If the cancel button is not showing next to the payment, call the Credit Union directly to stop the payment (800.527.3328). Stop payments on transactions that have already been sent to the biller are subject to the Credit Union’s stop payment fee. View our Fee Schedule for the current stop payment fee.

You can make payments to virtually any business or individual in the United States. Exceptions include:

- Tax payments

- Court ordered payments

- Payment to payees outside of the United States

- Payments to other institutions for the purpose of making a deposit

Bill Payment is fully secure. It is recommended by security experts over paper bills to help protect against check fraud and identity theft.

SSL (secure sockets layer) and 128-bit encryption ensures that your connection and information are secure from outside inspection, making information unreadable as it passes over the Internet

This security protects your use of all the products offered in Online Banking (Bill Payment and eStatements).

If you have an account with us, your routing number is 322276855.

Checking

A DBO (Debit Origination) is an automatic withdrawal set up by the Credit Union (on behalf of the Member), from an account at another financial institution, using a routing and account number to satisfy a consumer loan payment.

An LTA (Loan Transfer Agreement) is an automatic transfer from an LBS Financial account to an LBS Financial loan. These types of transfers are set up by the Credit Union (on behalf of the Member) to automatically transfer funds on the date a Member’s payment is due every month. LTAs will attempt to debit a Member’s account up to 4 times to satisfy a consumer loan payment (if there are insufficient funds).

Call us at 800.527.3328 and press 2 for ATM and debit card. Then press 1 for lost/stolen.

College Students

Yes. Every Member must open a Share Savings account which becomes their Membership account at the Credit Union. Our Share Savings account requires a minimum deposit of $5, plus a one-time membership fee of $1 (per Member on the account). You must maintain the $5 minimum balance to keep your Membership in good standing. For Free Checking with eStatements, there is a $20 opening deposit (no minimum balance thereafter).

We will send monthly paper statements or eStatements for Members with checking accounts. If you do not have a checking account, you will receive quarterly paper statements or eStatements unless you make electronic withdrawals or deposits (ACH) or have ATM activity associated with this account in a given month. Then we will send you a monthly statement.

Coverdell ESA

This account can be opened at any of our branches. Just stop by and we'll get you set up.

Credit Card Conversion

LBS Financial Credit Union went through a conversion affecting all of our credit cards (moving our credit cards from an older system to a new system). As part of this process, we created new product names/designs and offered new benefits. We did have to issue new card numbers for every Member due to the conversion from one system to another. Members can activate and use their new contactless credit card starting March 26, 2023.

We encourage you to check the card numbers and expiration dates you have on file with every merchant to ensure your payments continue smoothly. Some merchants are able to update the card number automatically (once your new card is activated), but there may be some that require you to make a manual update.

New credit card eStatements can be accessed within the Credit Card Center in Online & Mobile Banking. Older eStatements can still be accessed within the eDocuments section of Online & Mobile Banking (for up to 18 months from statement date).

A black out period occurred between March 24th through March 25th (no new points earned during this time). On Thursday, March 23, 2023 all remaining Visa Gold Points were paid to your Share Savings account. On March 26, 2023, Members should activate their new Platinum Rewards Credit Card and can take advantage of the new rewards program.

No. You will need to add your new Onshore or Platinum Rewards Credit Card to your Mobile Wallet on or after March 27, 2023.

E-Bills

eBills are regular statements delivered electronically by your eligible billers. You'll typically receive them each month at the same time you would receive a paper bill.* You can pay them automatically with Auto-Pay (under a certain dollar amount), or pay them manually within Online or Mobile Banking.

When you set up a biller in Bill Payment, you will have the option to set up eBills for eligible billers. To add eBills to an existing biller within Online Banking, select “Activate eBill” next to the biller on the Payment Center page. Within the Mobile Banking app, select “Activate eBill” on the billers tab.

*Please note that you'll no longer receive a paper bill if you opt into eBills. However, you can print or save your eBill statements for your records.

Most Payees/Billers will use their established billing cycle, so you can expect to receive your bill at approximately the same time of the month that you currently receive your paper bill.

When you log on, you'll see the number of new E-Bills, statements, and notices you've received. You'll also receive a reminder email to notify you of new E-Bills in your account mailbox if they have not been viewed within four days of delivery.

You will no longer receive a paper bill. However you can print a paper copy of any E-Bill, if you like. Your bills, statements, and notices are available online for six months from their arrival date. Contact your financial institution/payee directly for records after six months.

eStatements

A DBO (Debit Origination) is an automatic withdrawal set up by the Credit Union (on behalf of the Member), from an account at another financial institution, using a routing and account number to satisfy a consumer loan payment.

An LTA (Loan Transfer Agreement) is an automatic transfer from an LBS Financial account to an LBS Financial loan. These types of transfers are set up by the Credit Union (on behalf of the Member) to automatically transfer funds on the date a Member’s payment is due every month. LTAs will attempt to debit a Member’s account up to 4 times to satisfy a consumer loan payment (if there are insufficient funds).

Statements, tax documents, billing notices, and eNotices (Share IRA and Share Certificate disclosures and maturity notices) are currently available within eStatements. You can choose which ones you prefer to remain paper or make them all electronic!

If you switch from paper statements to electronic statements, you will no longer receive a paper statement in the mail. You may always switch back to paper statements if you change your mind.

If you have already registered for eStatements: click on eDocuments in the top left toolbar within Online Banking. Documents are stored here for up to 18 months.

If you have not registered for eStatements: click on eDocuments and switch to electronic for any documents on the list. Then, make sure to read the disclosure and accept terms. Once you agree, you will have access to the system. You will not have an eStatement ready for you until the next statement period.

Home Equity Line of Credit

There are three ways you can start the process: apply online, call 800.527.3328 and ask to speak to one of our loan experts, or call us to schedule a visit with a loan expert at one of our branches.

Both loans use the value in your current home to secure a low rate. A Home Equity Loan is paid out as one large sum, whereas a HELOC approves you for a limit that works similar to a line of credit or credit card, which you can then borrow from here and there as you need it (you'll only pay interest on what you actually borrow). A Home Equity Loan is great if you know exactly how much you want to borrow; a HELOC might be a better choice if you have ongoing expenses.

It depends on the value of your home and any current loans outstanding. Get pre-approved online today and start the process.

Home Equity Loans

There are three ways you can start the process: apply online, call 800.527.3328 and ask to speak with one of our loan experts, or call us to schedule an appointment to meet with a loan expert at one of our branches.

Both loans use the value in your current home to secure a low rate. A Home Equity Loan is paid out as one large sum, whereas a HELOC approves you for a limit that works similar to a line of credit or credit card, which you can then borrow from here and there as you need it (you'll only pay interest on what you actually borrow). A Home Equity Loan is great if you know exactly how much you want to borrow; a HELOC might be a better choice if you have ongoing expenses.

It depends on the value of your home and any current loans outstanding. Get pre-approved online today and start the process.

Comparing the features of each loan will help you reach the best decision:

| Cash-Out Refinance | Home Equity Financing |

|---|---|

| One loan and one monthly payment | Choose between a one-time loan advance or a revolving line of credit. |

| Your existing mortgage is refinanced for a higher overall amount using some of the accumulated equity in your home | You can borrow your home's equity as determined by the current value and less any existing liens on the property. |

| Get immediate cash and spread the payments out over a longer timeframe | Flexibility of a shorter term to help build equity faster OR reduced monthly payments by spreading the cost over a longer term. |

| Usually a lower interest rate than home equity financing | You can borrow more money - sometimes up to 80% of the value of your home. With a line of credit, interest is paid only on the money you actually use, and you can access it whenever you want without having to reapply. |

Home Purchase

There are 5 easy ways to make your home loan payment

- From your LBS Financial Savings or Checking account – Payments can be made using the transfer option within Online Banking or Mobile Banking. Please note that money will be immediately debited from your LBS Financial Savings or Checking account and applied to your mortgage loan later that evening, if set up before 8 p.m. If set up after 8 p.m., the money will still be immediately debited from your account but will not be applied to your mortgage loan until after 8 p.m. the next business day.

- From an Account at Another Financial Institution- Located in the Mortgage Center section of Online Banking or Mobile Banking.

- Electronic Payments Set Up by the Credit Union- Set up your recurring transfers to withdraw funds on the 1st, 5th, 10th, or 15th of the month. You must complete the Authorization Agreement for Automatic Mortgage Payments form at any branch or contact our Call Center at 800.527.3328.

- Call Us- Contact our Call Center at 800.527.3328 to make a payment by phone.

- Mail Us Your Payment- Mail us your payment each month to: LBS Financial Credit Union, P.O. Box 4860, Long Beach, CA 90804

Visit the Home Loans section of our website for details about the products and services we offer. We offer online pre-approvals, rates and detailed information within this section and our Mortgage Web Center.

There are three ways you can start the process: apply online, call 800.527.3328 and ask to speak with one of our loan experts, or call us to schedule an appointment to meet a loan expert at one of our branches.

The meeting will last approximately 1 hour and will be held either at the Escrow Company’s office or a Notary may come to your home. The steps below explain what happens during and after closing:

- The respective closing agent reviews the settlement sheet with you.

- You sign all loan documents.

- You then present a cashier's check or wire funds to pay closing costs (if applicable).

- If your monthly payments are to include property taxes and insurance, a new escrow account (or reserve) is opened when the loan is funded.

- The loan is funded by the Lender. The funds are transferred to the Escrow, who in turn, instructs the Title company to set up recording of the documents. The Deed and any other documents are usually recorded the following day. Once recording is confirmed, the Escrow agent can disburse funds for any payoffs. Remaining funds are sent to you with the Closing Disclosure.

Prior to the closing, our Residential Lending Department closer will contact you to let you know the amount of funds you must bring to the Closing Meeting. Personal checks are not accepted--cashier's checks or wired funds only.

The closing (or settlement) of the loan is an actual meeting that takes place at the Escrow Office, one of our branches, or the escrow's signer can come to your home or place of employment. At that time, you'll be asked to sign the closing documents and pay any outstanding closing costs you are responsible for.

If you are a first time home buyer and your home loan exceeds 80% loan to value, you will be required to purchase Mortgage Insurance and attend a First Time Home Buyers Seminar. You can learn more about home buying and take the First Time Home Buyers test online. Be sure to enter the Buyers Ed Code: homeloans@lbsfcu.org.

That depends on you and your current financial situation and long term financial goals. The following is a brief analysis of each type of loan, and the benefits of choosing one type over another.

- Fixed Rate Loans

Fixed Rate Loans, by their very nature, are the most stable of the loan categories. With interest rates and payments fixed over the life of the loan (generally 15, 20 or 30 years), homeowners can rely on knowing exactly what their mortgage payment will be each and every month. If it is important to you to have your rate and payment constant, or if you plan to be in this home for a long period of time without moving, a fixed rate loan may be the best option for you. See Mortgage Loan Rates. - Adjustable Rate Mortgages (ARMs)

Adjustable Rate Mortgages (ARMs), conversely, often offer low start rates that then change with the marketplace. It is the low start rate that makes ARMs more attractive to many borrowers. An ARM is a great option if you are planning to move from this home within a few years. By having a low start rate, borrowers benefit from increased buying power, with the ability to afford a higher loan amount than with many fixed rate loans. Buyers, however, need to keep in mind that the rates can change dramatically once the fixed-rate period ends. Even with pre-set life caps, which limit how much the rate can "adjust," rates can increase substantially. See Mortgage Loan Rates. - Fixed/Adjustable Combination Loans

Fixed/Adjustable Combination Loans are described by many as the "best of both worlds." These loans enable borrowers to enjoy the stability of a fixed rate loan during the early years of the loan, while also experiencing the increased buying power of an ARM. Start rates on this type of mortgage are often lower than standard fixed rate loans. Fixed/adjustable combination loans are often ideal for individuals who anticipate earning greater income during the later years of the loan, but would benefit from a lower payment in the beginning. See Mortgage Loan Rates

PMI is a necessary expense when you buy a house with less than a 20% down payment. PMI is additional insurance written by a private company protecting the mortgage lender from mortgage default.

Plan on 1%-3% of the market value of your home. For example, if your home has a market value of $500,000, property taxes might be $5,000 to $15,000, depending on where you live. If your property is located in a Mello Roos bond area, property taxes may be affected. Ask your LBS Financial loan specialist about your specific property area.

A ratio of the amount of money you wish to borrow compared to the value of the property you wish to purchase. An 80% LTV on a $100,000 property would equal an $80,000 loan. The property value is determined by either the appraised value or the purchase price, whichever is less.

A neutral party who holds the legal documents and funds on behalf of a seller and buyer or a lender and a borrower, until the parties have satisfied all of the conditions to "close."

An origination fee is what the lender charges for making the mortgage loan. The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination fees are expressed as a percentage of the loan amount. One percent equals 1% of the loan amount.

Here is a list of the information you should collect and have ready once you accept our Loan Estimate (following the application). Original documentation, when requested, is preferred and will be returned to you promptly.

| Category | Sub-category | Brief Description |

|---|---|---|

| Loan Application | Loan application form | Loan application form signed and dated by all applicants |

| Income documentation |

|

|

| Self-employed | Most recent two full years of tax returns (individual, corporation, or partnership) | |

| Retired |

|

|

| Other Income | Other income requirements | If Other Income is needed to qualify for the loan, supporting documentation and history of receipt may be a requirement. |

| Assets | Evidence of sufficient funds when closing |

|

| Obligations | Evidence of financial obligations (debts) | Copy of the fully-executed Divorce Decree indicating amount of child support, alimony, or separate maintenance payments |

| Property | Documentation |

|

Wise investors usually order a credit report to review its accuracy. This step gives them a chance to address any errors or mishaps before approaching the lender. As part of the process, LBS Financial will eventually order your credit report, so it's a good idea to address it beforehand so as to avoid delays. Note that LBS Financial cannot use the credit report you have obtained and will need to order a credit report as well.

Home Refinance

The closing (or settlement) of the loan is an actual meeting that takes place at the Escrow Office, one of our branches, or at your home or place of employment. At that time, you'll be asked to sign the closing documents and pay any outstanding closing costs you are responsible for.

To help speed up a refinance requiring standard processing, here is a list of the information you should collect and have ready to provide once you accept our Loan Estimate (following the application). Original documentation, when requested, is preferred and will be returned to you promptly.

| Category | Sub-category | Brief Description |

|---|---|---|

| Loan Application | Loan application form | Loan application form signed and dated by all applicants |

| Income documentation |

|

|

| Self-employed | Most recent two full years of tax returns (individual, and corporation, or partnership) | |

| Retired |

|

|

| Other Income | Other income requirements | If Other Income is needed to qualify for the loan, supporting documentation and history of receipt may be a requirement. |

| Assets | Evidence of sufficient funds when closing |

|

| Obligations | Evidence of financial obligations (debts) | Copy of the fully-executed Divorce Decree indicating amount of child support, alimony, or separate maintenance payments |

| Property | Documentation |

|

Wise investors usually order a credit report to review its accuracy. This step gives them a chance to address any errors or mishaps before approaching the lender. As part of the refinance process, LBS Financial will eventually order your credit report, so it's a good idea to address it beforehand. Note that LBS Financial cannot use the credit report you have obtained and will need to order a credit report as well.

At LBS Financial, you'll find a number of home loans for every type of refinance. The goal here is to match the benefits of a specific loan type with your goals. So, let's first look at your goals or needs:

| Your Situation | Consider the following strategy |

|---|---|

| Have little cash | Equity loan |

| Need low closing costs | Ask about our no closing cost options |

| Want to lower your rate and payment but plan to stay over 5 years | Fixed rate loan |

| Want to lower your rate and payment and sell within 5 years | ARM |

| Add a room or other home improvements | Equity cash-out refinance or Home Equity Line of Credit |

| Want to avoid monthly private mortgage insurance | Loan-to-value at 80% or less on 1st mortgage |

| Financing a 2nd home (vacation) | 30-year fixed-rate |

| Want consistent monthly payments | Fixed-rate loan |

Our LBS Financial loan specialist will be happy to go over the options in more detail. Give us a call or visit a branch today.

You can usually lower the rate by paying more points. Points are fees paid to the lender at closing. Each point is equal to 1% of the loan amount. For a $100,000 loan, a point equals $1,000. Two points would be $2,000. If you have the cash, it's a good way to save money on interest over the life of your loan.

Below is a chart showing all of the types of potential closing costs associated with a home loan and which fees may be charged by LBS Financial, depending on your loan type:

| Customary Fees & Charges | LBS Financial |

|---|---|

| Loan origination fees | If applicable |

| Loan discount/origination points | If applicable |

| Application/processing/underwriting fees | Yes |

| Document preparation fees | Yes |

| Appraisal fees | Yes |

| Credit report fees | Yes |

| Mortgage insurance | If applicable |

| Tax service | If applicable |

| Flood determination fee | Yes |

| Escrow fees | Yes |

| Attorney fees | No |

| Abstract or title fee | If applicable |

| Title insurance | Yes |

| Recording fee and transfer taxes | Yes |

| Notary fee | Yes |

| Survey fee | No |

During a refinance, you may have costs for adjustments or prorations. These are called pre-paid costs, such as property taxes, prepaid interest, and homeowner hazard insurance.

Yes! Provide our LBS Financial loan specialist with the details of your first and second mortgages, and we will present the potential options for consolidating your mortgages. Or apply online now!

Yes! Credit cards, car loans, student loans, revolving credit and other debts can be consolidated. An LBS Financial loan specialist will present the potential options for debt consolidation.

Comparing the features of each loan will help you reach the best decision:

| Cash-Out Refinance | Home Equity Financing |

|---|---|

| One loan and one monthly payment | Choose between a one-time loan advance or a revolving line of credit. |

| Your existing mortgage is refinanced for a higher overall amount using some of the accumulated equity in your home | You can borrow your home's equity as determined by the current value and less any existing liens on the property. |

| Get immediate cash and spread the payments out over a longer timeframe | Flexibility of a shorter term to help build equity faster OR reduced monthly payments by spreading the cost over a longer term. |

| Usually a lower interest rate than home equity financing | You can borrow more money - sometimes up to 80% of the value of your home. With a line of credit, interest is paid only on the money you actually use, and you can access it whenever you want without having to reapply. |

When you refinance your mortgage, you're actually replacing it with a brand new mortgage loan. Expect to go through a mortgage application process very similar to that of your original mortgage. Refinancing is often a sound financial choice that can allow you to meet a variety of needs, such as lowering your monthly payments; changing from adjustable to fixed rate loan; taking cash out of your current home equity; or eliminating private mortgage insurance.

Interest Checking

You are welcome to request a free Debit Card for this account. Certain qualification requirements may apply.

If you have an account with us, your routing number is 322276855.

We will send monthly paper statements or eStatements for Members with checking accounts. If you do not have a checking account, you will receive quarterly paper statements or eStatements unless you make electronic withdrawals or deposits (ACH) or have ATM activity associated with this account in a given month. Then we will send you a monthly statement.

IRA Certificates

You can check your balance 24/7 days week by using our automated phone banking, HomeTeller. You can also speak to one of our representatives during normal business hours.

The routing number and transit number for LBS Financial is 322276855.

Mobile Banking

A DBO (Debit Origination) is an automatic withdrawal set up by the Credit Union (on behalf of the Member), from an account at another financial institution, using a routing and account number to satisfy a consumer loan payment.

An LTA (Loan Transfer Agreement) is an automatic transfer from an LBS Financial account to an LBS Financial loan. These types of transfers are set up by the Credit Union (on behalf of the Member) to automatically transfer funds on the date a Member’s payment is due every month. LTAs will attempt to debit a Member’s account up to 4 times to satisfy a consumer loan payment (if there are insufficient funds).

Zelle is a fast, safe and easy way to send and receive money with people you trust. We are not a Zelle partner institution, but our debit cards can work with Zelle when the other financial institution is a partner. Refer to our Zelle Guide on how to add your LBS Financial Debit Card on Zelle.

Viewing your credit report and credit score within the Credit Score feature does not impact your credit score. For more details on how other actions can impact your credit score, please explore the options within SavvyMoney, including the Score Simulator and Resources tab.

The SavvyMoney Credit Score feature available in Online and Mobile Banking gives Members free access to their credit score, credit report, and other tools to help them make smarter credit choices and save money.

Members have access to resources such as:

- Comprehensive credit score analysis

- Daily credit score updates

- Full credit report

- Monitoring and alerts

- Personalized offers

- Score simulator

- Educational articles

- Credit Goals

Members can sign up within Online or Mobile Banking by clicking on either the “Show my Score” button (Online) or the “Credit Score” menu item (Online or Mobile) and following the prompts and agreeing to the terms provided. Please note, an email address is required for access to this feature.

The initial set-up of an external account must first happen within Online Banking. Open the "Transfers & Payments" section and select “External Transfers” in Online Banking and then select “Add new payee.” Verify and enter requested external account information, then click “Link account.”

Within two business days, there will be two small deposits under $1 in your external account. When you see these transactions, return to “External Transfers” on your LBS Financial account to confirm the amounts. You will now be able to transfer money to and from your external account by selecting it on the “Make a Transfer” page in Online Banking or by clicking “Transfer” in the Mobile Banking app.

Yes! Just download our app from the App Store!

Mobile Banking is a wireless Internet-based service that allows you to bank safely and conveniently from your tablet or mobile device. You can access Mobile Banking by downloading our app through the Apple app store or Google Play store. You do not need to enroll in Online Banking first.

View account balances and share history, view account holds and pending items, see copies of paid drafts, set up account alerts, view eStatements and eDocuments, transfer money, make a loan payment, and pay bills.

Your security is of our top importance. Our Mobile Banking platform uses the same robust security measures that are available in Online Banking. Your password or fingerprint is required every time you sign in to Mobile Banking. We use Multi-Factor Authentication (MFA) which adds an additional layer of authentication. You will receive a one-time PIN for any new devices accessing our systems or for certain changes or transactions made on your account. SSL (secure sockets layer) and 128-bit encryption ensures that your connection and information are secure from outside inspection, making information unreadable as it passes over the Internet.

Mobile Banking is a free service to LBS Financial Members. However, your cell phone carrier may still charge for text and data usage. Check with your mobile carrier for more information.

Mobile Wallet

Both LBS Financial Debit and Credit Cards work with Apple Pay.

- First you must be using an eligible iOS device

- Go to Wallet and tap on +

- Follow the steps to add a new card.

- Tap Next. You may receive a one-time PIN or may be prompted to contact the Credit Union for activation. When you have the information, go back to Wallet and tap your card.

- After the Credit Union verifies your card, tap Next.

- Start using your LBS Financial card directly from your phone to pay!

For more specific steps by device, visit the Apple website.

Once you have your LBS Financial Debit or Credit Card set up within the Wallet, just look for the Apple Pay symbol at checkout and double click the side button to authenticate with Face ID (or rest your finger on the Touch ID or enter your PIN) and hold your device near the contactless reader.

For more detailed instructions, visit the Apple website.

Samsung Pay is available with LBS Financial Credit Cards and Debit Cards

- Samsung Pay is usually preloaded on Samsung Devices. If not, install from the Google Play store.

- Once installed, tap Get Started. Enter a new PIN for Samsung Pay, and then enter it again to confirm.

- Within the app, tap Menu in the top left corner , then tap Cards.

- Tap Add card and then tap Add credit/debit card.

- Follow the on-screen instructions to register your card.

- Agree to the card's terms and conditions.

- You will be prompted to call the Credit Union to complete the activation.

For more specific steps by device, visit the Samsung Website.

To set up Samsung Pay, using your Samsung mobile device, swipe up from the home button. You may also select the Samsung Pay app icon from your home screen or app tray. To authorize payments you simply scan your fingerprint (or enter a PIN). Just hold your mobile device over the in-store reader to pay!

Google Pay works with LBS Financial Debit and Credit Cards on both Android and iOS devices.

- Download the Google Pay app from the Google Play or Apple Store.

- Once installed, open the Google Pay app .

- At the bottom, tap Payment.

- Select a card or payment account.

- Tap Set up in-store payments. You may need to enter the expiration date and CVC on the back of your card. You will be prompted to call the Credit Union for the initial activation.

For more specific steps, visit the Google Pay website.

Once you have your LBS Financial Debit or Credit Card set up within Google Pay, look for the contactless or Google Pay symbols at checkout. Turn on your phone screen, and then unlock your phone. You do not need to open the Google Pay app. Hold the back of your phone close to the payment reader for a few seconds. If prompted, follow instructions on your screen (may occur at stores with older software).

For more detailed instructions, visit the Google Pay website.

Money Market

You can check your balance 24/7 days week by using our automated phone banking, HomeTeller. You can also speak to one of our representatives during normal business hours.

The routing number and transit number for LBS Financial is 322276855.

Motorcycle Loans

We offer several options for paying off your LBS Financial auto loan. Please call us to get your pay off amount as the amount changes daily due to interest.

Options for paying off a vehicle loan:

1. Transfer options

- Transfer funds from an LBS Share Savings or Checking to your loan with Online or Mobile Banking

- Transfer funds from an account outside the Credit Union to your LBS Financial Savings or Checking account using the Online and Mobile Banking external transfer feature, then transfer money to pay your loan from your LBS Financial account. External transfer limits apply and transfers can take 3 business days to process. Click here for more information about external transfers.

2. Pay on our website using LBS Easypay

- Routing and checking account information is required

- $5,000 limit applies per business day

3. After contacting us to get your payoff amount for a future date, set up a payment through your financial institution's bill payer.

- You may need to provide them with the following information:

- Payee name: LBS Financial CU

- Routing number: 322276855

- Your LBS Financial CU Member account number: XXXXXX (To ensure the payment is routed to your loan, add your loan suffix number to the end of your Member number, such as 01 or 02)

- There may be a limit on the amount you can send, please contact your financial institution’s bill payer for their limits.

4. Use our payment by phone option with your routing and checking account information

- Call 866.923.6404 to pay through the automated phone system or call us to pay with a representative

- $10,000 limit per business day

5. Visit one of our eight branches or any CO-OP Shared Branch in the United States to deposit your payment to your Share Savings account to be transferred to your loan.

6. After contacting us to get your payoff amount for a future date, you can pay by mail by sending your check to:

LBS Financial Credit Union

P.O. Box 4860

Long Beach, CA 90804-0860

When LBS Financial obtains your credit score during the pre-approval process, the Credit Union will determine your loan rate based on your past financial history and credit. Take note that the Credit Union must obtain your credit report personally; they will not accept copies of credit reports from third parties.

We process most applications within one business day. Applications received over the weekend or holidays are processed the next business day. You may check your status by calling us.

There are a variety of ways to make a payment towards your LBS Financial loan.

LBS EasyPay

Use our LBS EasyPay service to make one-time or recurring payments to your LBS Financial Consumer Loan from an account at another financial institution. There is no fee for this self-service payment channel and it can be accessed from any browser on a computer or mobile device. Access LBS EasyPay.

There’s no charge for this service.

Schedule Recurring Payments through Online Banking:

You may establish a recurring transfer from your LBS Financial account to your LBS Financial loan. Log in to Online Banking to set up your automatic transfer.

There’s no charge for this service.

External Transfers

Transfer money from an account outside the Credit Union to your LBS Financial Savings or Checking account using Online and Mobile Banking, then transfer money to pay your loan from your LBS Financial account.

There’s no charge for this service.

Make a Payment by Phone

You may make a payment from another financial institution to your LBS Financial Credit Union loan by calling 866.923.6404. View our Fee Schedule. You may also call 800.527.3328 to make a payment from your LBS Financial account to your LBS Financial loan at no cost to you.

In Person:

Visit one of our eight branches or any CO-OP Shared Branch in the United States to drop off your payment. Find a branch or ATM.

Mail:

You may pay by mail by sending your check, along with a loan payment coupon or the remittance portion of your monthly billing statement (depending on the type of loan you have) to:

LBS Financial Credit Union

P.O. Box 4860

Long Beach, CA 90804-0860

In your time of need, our claims process is quick and easy. If you elected payment protection on your loan, you can use this convenient claims process to quickly and easily file your claim.

To begin, please fill out a claim form. If you prefer, call 800. 621.6323 to begin the process and a CUNA Mutual Group Claims Specialist will guide you through the process.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Payment protection products include debt protection products available through the Credit Union.

Give us a call and we will tell you the payoff amount.

Online Banking

A DBO (Debit Origination) is an automatic withdrawal set up by the Credit Union (on behalf of the Member), from an account at another financial institution, using a routing and account number to satisfy a consumer loan payment.

An LTA (Loan Transfer Agreement) is an automatic transfer from an LBS Financial account to an LBS Financial loan. These types of transfers are set up by the Credit Union (on behalf of the Member) to automatically transfer funds on the date a Member’s payment is due every month. LTAs will attempt to debit a Member’s account up to 4 times to satisfy a consumer loan payment (if there are insufficient funds).

It's easy to sign up. Visit our home page to enroll online by clicking on "Sign Up" near our login box. View our How to Enroll in Online Banking video.

Yes. Visit our home page to enroll online by clicking on Sign Up near our login box. View our How to Enroll in Online Banking video.

To access your account, you will need the following:

- You must apply from the link in the Online Banking login box that says “Sign-Up”

- Any type of computer, tablet, or mobile device that can access the Internet

- An Internet Service Provider

- A Web browser that meets our minimum specifications

- Your LBS Financial account number

- Your social security number

- Your date of birth

Only the most current versions of Internet browsers are supported for security purposes. Online Banking should work with Microsoft Edge, Chrome, Firefox, and Safari. You may also choose to use our Mobile Banking by downloading one of our Mobile apps from the Apple or Google Play stores if you have a tablet or mobile device.

Every Member has a unique user name and password. We recommend that you don’t share your user name and password with anyone.

Online Banking uses Multi-Factor Authentication (MFA) to verify your identity. When you access Online Banking from a new device, you will be sent a one-time PIN via email or text.

SSL (secure sockets layer) and 128-bit encryption ensures that your connection and information are secure from outside inspection, making information unreadable as it passes over the Internet

This security protects your use of all the products offered in Online Banking (Bill Payment and eStatements)

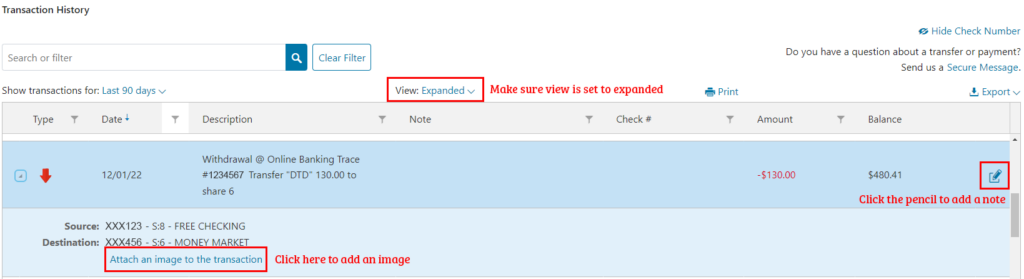

To add a note or image to your Online Banking history, first log in to Online Banking. From your dashboard, click on "History" on the left hand side. Make sure your view is set to “Expanded" and click on the pencil icon next to a transaction to add your note. Enter your text in the “Add note” box, then click on the check mark on the right to save. To add an image, click on the “Attach an image to the transaction” link below your transaction to upload the image from your device. You can upload a JPG, JPEG, or PNG image file. The maximum file size is 3 MB, and the photo must be at least 640 x 480 pixels.

Zelle is a fast, safe and easy way to send and receive money with people you trust. We are not a Zelle partner institution, but our debit cards can work with Zelle when the other financial institution is a partner. Refer to our Zelle Guide on how to add your LBS Financial Debit Card on Zelle.

Viewing your credit report and credit score within the Credit Score feature does not impact your credit score. For more details on how other actions can impact your credit score, please explore the options within SavvyMoney, including the Score Simulator and Resources tab.

The SavvyMoney Credit Score feature available in Online and Mobile Banking gives Members free access to their credit score, credit report, and other tools to help them make smarter credit choices and save money.

Members have access to resources such as:

- Comprehensive credit score analysis

- Daily credit score updates

- Full credit report

- Monitoring and alerts

- Personalized offers

- Score simulator

- Educational articles

- Credit Goals

Members can sign up within Online or Mobile Banking by clicking on either the “Show my Score” button (Online) or the “Credit Score” menu item (Online or Mobile) and following the prompts and agreeing to the terms provided. Please note, an email address is required for access to this feature.

Duplicated transactions can appear within Quicken due to a slight difference in the transaction ID between old and new files. In order to identify older transaction and manually remove the duplicates, please follow these steps:

- Go to Settings by clicking on the Settings icon in the top right-hand corner in Quicken and select the “Register Columns…” option.

- From that menu, select “Downloaded ID.” You will see a new column appear on your screen.

- In that column, identify transactions that have 11 symbols after the last colon ( : ). These are the transactions with an older transaction ID format. The newer transaction ID format has 10 symbols after the last colon.

- To delete older transactions, click on the Gear icon in the Transaction toolbar and then click “Delete”.

For more information on deleting transactions, please visit the Quicken website.

View our video showing the steps for deleting duplicate transactions.

To prevent or reduce duplicates, when exporting your transactions, select a start date that is equal to or after your last export date.

Yes, you can export your account information from Online Banking into Quicken. Just click on History from our menu, then select the account for which you would like to view in the drop down. Click on the Export button above the history information to export to Quicken or a CSV, Excel, or OFX file.

There are no limits on how often you can use Online Banking. Visit Online Banking as often as you like.

There are no limits on transfers from LBS Financial Checking accounts or lines of credit.

Yes, joint owners can access the account and we encourage them to enroll separately.

Online Banking is available 24 hours a day/7 days a week. If you need to talk with an LBS Financial representative regarding Online Banking, someone will be available to help you during normal business hours. You may also submit a Secure Message to us through Online or Mobile Banking and we will respond during business hours.

Please submit a Secure Message through Online or Mobile Banking, or call us at 800.527.3328 during normal business hours.

In Online Banking, click on History and click on your Checking account. Enter the check number in the search box under Transaction History. You may also find the checks within the history on your account and click on the check icon to view. If you are signed up for eStatements you may also view your checks directly from the eStatement.

From Online Banking, you can print your account history directly from the History page by clicking on the print button. By opting-in to eStatements, you can also print your statements as needed.

Repeating or recurring transfers are automatic transfers of the same amount of money, from one account at LBS Financial to another account. For example, from your Checking account to your auto loan or home loan. You do not have to re-enter a new transfer each month. They are a great way to make sure you never miss a monthly payment or savings goal.

These transfers can be scheduled for a variety of frequencies, including: daily, weekly, monthly, and annually.

To set up a repeating transfer, click on the “Make a Transfer” button in the left toolbar of Online Banking. Select the account you want the money to come from, and then where you want the money to go to. Enter the amount, and then select "Repeating Transfer" and submit.

In Online Banking, click on "Transfers and Payments" and "Make a Transfer" or tap on "Transfer" within the Mobile Banking app. Choose the account you want to withdraw from and where you want to send the money to. If you are sending to another Member, select "Another Member" under where the money is going, and enter their account number and last name. Enter the amount and submit.

If you would like to transfer funds to an external account where you are an account owner, select “External Transfers” within Online Banking and then select “Add new payee.” Verify and enter requested external account information, then click “Link account.” Within two business days, there will be two small deposits under $1 in your external account. When you see these transactions, return to “External Transfers” on your LBS Financial account to confirm the amounts. You will now be able to transfer money to and from your external account by selecting it on the “Make a Transfer” page in Online Banking or by clicking “Transfer” in the Mobile Banking app.

Online Banking is free of monthly service charges. In addition, our Bill Payment service is also available without a monthly service charge.

Most transactions are posted instantly to your account (in real-time) just as if you were to visit one of our branches or called one of our phone representatives. Some signature debit card transactions may show as a hold or pending and may be viewed as a pending item in your overview or account history.

You can access all of your LBS Financial sub-accounts. If you have multiple accounts at the Credit Union, make sure to click on Link Memberships to bring in all accounts for which you are an owner. View our How to Link Memberships video.

Yes. Your access will be limited if your account has become dormant due to no transactions for 12 months or longer. To regain access, simply contact the Credit Union. All of your settings (account order, recurring transfers, account nicknames, etc.) will still be there when we reactivate your account.

Yes, as long as you can access the Internet using a web browser that meets our minimum requirements, you may use Online Banking from any location in the world, 24 hours a day. We recommend accessing through a secure wireless network and not using public Wi-Fi to ensure security on your account.

If you have already registered for eStatements, click on eDocuments in the left toolbar within Online Banking. Documents are stored here for up to 18 months. If you have not registered for eStatements: click on eDocuments and switch to electronic for any documents on the list. Then, scroll to the bottom of the page, read the disclosure and accept terms. Once you agree, you will have access to the system. You will not have an eStatement ready for you until the next statement period.

If you switch from paper statements to electronic statements you will no longer receive a paper statement in the mail. You may always switch back to paper statements if you change your mind.

To reset your password, click on the Forgot Password link below our login box on the home page of our website. You will be required to enter your social security number, account number, and date of birth to regain access to your account.

Most login problems are due to incorrect user IDs and passwords. Our passwords are case sensitive. Be sure you don’t accidentally have your keyboard CAPS LOCK on. Be careful of the caps lock when you set your password as well.

Personal Loans

When LBS Financial obtains your credit score during the pre-approval process, the Credit Union will determine your loan rate based on your past financial history and credit. Take note that the Credit Union must obtain your credit report personally; they will not accept copies of credit reports from third parties.

In your time of need, our claims process is quick and easy. If you elected payment protection on your loan, you can use this convenient claims process to quickly and easily file your claim.

To begin, please fill out a claim form. If you prefer, call 800. 621.6323 to begin the process and a CUNA Mutual Group Claims Specialist will guide you through the process.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Payment protection products include debt protection products available through the Credit Union.

Share Secured Loan funds can be secured from one or more accounts and can be repaid in one lump sum in one year from borrowing (up to 90% of unencumbered shares) or you may make monthly payments for up to a 5 year* repayment period (up to 90% of unencumbered shares). For Share Certificate Loans, the term of the loan is determined by the maturity date of the certificate—the loan comes due at the same time the certificate matures.

*A Share loan at 3.15% APR for 60 months will have a monthly payment of $18.01 per $1,000 borrowed or a $54.04 monthly payment based on an amount financed of $3,000.

Signature Loans have a maximum repayment period of 5 years*.

Depending on your credit and other factors, you can borrow up to $30,000.

You can borrow up to 90% of the value of your savings account or share certificate. For example, let's say you have a savings account with us with $5,000. Then, your maximum loan would be $4,500.

Phone Banking

No, this is a service provided to our Members free of charge.

HomeTeller is available 24/7. Just call 800.527.3328 and dial 1 for HomeTeller.

Yes, all account owners on an account can access HomeTeller. Each account will be enrolled with one set of shared credentials.

You may reset your PIN by pressing or saying “9” for Main Menu, “5” for More Options, then “2” to change PIN or you may contact the call center to request a temporary PIN.

Each individual call to HomeTeller can retrieve up to the last 300 transactions in combination of debits, credits, payments and check history.

Yes, mortgage payments can be made by transferring funds within the same account number. Just give us a call at 800.527.3328 and dial 1 for HomeTeller. If you are not already set up for HomeTeller/phone banking, dial 0 for a call center representative.

No, the system will provide the principal balance only. However, the option to be transferred to a call center team member to obtain a payoff will be offered.

You can make a payment to your consumer loan (vehicles, boats, credit cards, and Home Equity Loan) from your checking or savings account at another financial institution using LBS EasyPay online, over the phone by calling LBS Financial and selecting option 4 (see our Fee Schedule for current fees), or by using the External Transfers feature within Online & Mobile Banking (external transfers can be made into your LBS Financial Savings or Checking account then transferred to pay your LBS Financial loan).

No, only interest-bearing payments are able to be made through HomeTeller.

No, cards cannot be blocked using HomeTeller. Please contact the call center directly during business hours at 800.527.3328. After hours, call 800.527.3328 and select 2 for Visa Debit Card or 3 for Visa Credit Card, then 1 for lost/stolen for assistance.

No, there is no limit to the quantity of transfers or dollar amounts within HomeTeller.

The option to be transferred to a call center team member is offered throughout various areas in the HomeTeller system. However, there is not always the option to press a specific button to be transferred to the call center. You may choose to hang up and call back and dial “0” to speak with a representative.

No, but you you may dial zero for the call center to order checks over the phone, visit a branch, or order through Online or Mobile Banking.

Yes, as long as the check clearing is within the most recent 300 transactions. Each individual call will retrieve up to the last 300 transactions in combination of debits, credits, payments and check history.

Since there is no timeout period, we ask that you please create a unique 4-digit temporary PIN. Try to avoid PINs such as 1234 or that include your Social Security number or date of birth.

Call LBS Financial for assistance. As you become familiar with the sequence for the transactions, you'll enjoy the convenience of banking from your phone using HomeTeller, a FREE service brought to you by LBS Financial Credit Union!

Powersports Loans

We offer several options for paying off your LBS Financial auto loan. Please call us to get your pay off amount as the amount changes daily due to interest.

Options for paying off a vehicle loan:

1. Transfer options

- Transfer funds from an LBS Share Savings or Checking to your loan with Online or Mobile Banking

- Transfer funds from an account outside the Credit Union to your LBS Financial Savings or Checking account using the Online and Mobile Banking external transfer feature, then transfer money to pay your loan from your LBS Financial account. External transfer limits apply and transfers can take 3 business days to process. Click here for more information about external transfers.

2. Pay on our website using LBS Easypay

- Routing and checking account information is required

- $5,000 limit applies per business day

3. After contacting us to get your payoff amount for a future date, set up a payment through your financial institution's bill payer.

- You may need to provide them with the following information:

- Payee name: LBS Financial CU

- Routing number: 322276855

- Your LBS Financial CU Member account number: XXXXXX (To ensure the payment is routed to your loan, add your loan suffix number to the end of your Member number, such as 01 or 02)

- There may be a limit on the amount you can send, please contact your financial institution’s bill payer for their limits.

4. Use our payment by phone option with your routing and checking account information

- Call 866.923.6404 to pay through the automated phone system or call us to pay with a representative

- $10,000 limit per business day

5. Visit one of our eight branches or any CO-OP Shared Branch in the United States to deposit your payment to your Share Savings account to be transferred to your loan.

6. After contacting us to get your payoff amount for a future date, you can pay by mail by sending your check to:

LBS Financial Credit Union

P.O. Box 4860

Long Beach, CA 90804-0860

Fill out an online application, or come see us at any branch.

When LBS Financial obtains your credit score during the pre-approval process, the Credit Union will determine your loan rate based on your past financial history and credit. Take note that the Credit Union must obtain your credit report personally; they will not accept copies of credit reports from third parties.

We process most applications within one business day. Applications received over the weekend or holidays are processed the next business day. You may check your status by calling us.

There are a variety of ways to make a payment towards your LBS Financial loan.

LBS EasyPay

Use our LBS EasyPay service to make one-time or recurring payments to your LBS Financial Consumer Loan from an account at another financial institution. There is no fee for this self-service payment channel and it can be accessed from any browser on a computer or mobile device. Access LBS EasyPay.

There’s no charge for this service.

Schedule Recurring Payments through Online Banking:

You may establish a recurring transfer from your LBS Financial account to your LBS Financial loan. Log in to Online Banking to set up your automatic transfer.

There’s no charge for this service.

External Transfers

Transfer money from an account outside the Credit Union to your LBS Financial Savings or Checking account using Online and Mobile Banking, then transfer money to pay your loan from your LBS Financial account.

There’s no charge for this service.

Make a Payment by Phone